Financial Services

The insurance penetration rate in Malawi is among the lowest in the world and in Africa, with the average rate over the last 5 years estimated to be between 2.8 to 3.5 percent

The Bankers Association of Malawi and the Institute of Bankers in Malawi promote standards of professional competency and levels of skill in banking and the financial services sector in the country

There are 8 commercial banks operating in Malawi. However, there is still opportunity for additional banks in the sector as the rate of financial inclusion is still relatively low at 20%

The financial services sector is overseen and regulated by the Reserve Bank of Malawi. The sector consists of banking, capital markets, the pension, insurance and, micro-finance institutions.

There are a total of 71 registered and licensed microfinance institutions in Malawi that are either deposit taking, non-deposit taking, or micro-credit agencies.

The sectoral contribution to GDP of the financial services sector over the past few years, with an estimation for 2021 and projections for 2022 and 2023

Sectoral contribution (%)

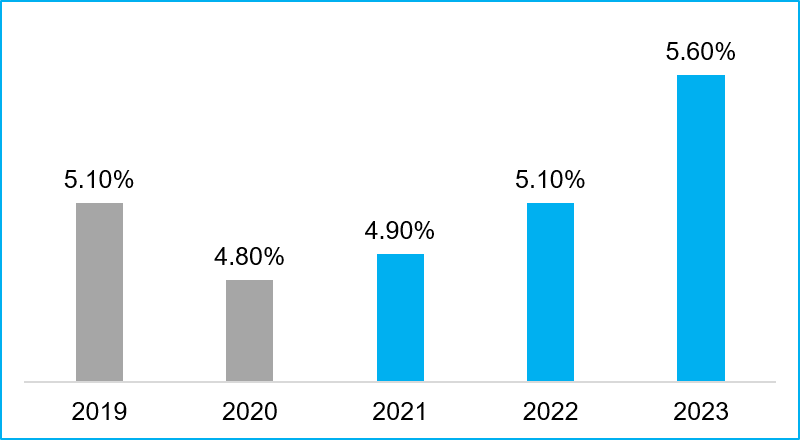

The annual percentage growth rate of the financial services sector over the past few years, with an estimation for 2021 and projections for 2022 and 2023

Annual percentage growth rates (%)

The investment opportunities in the financial services sector include

General insurance services

To meet demand for insurance for small and medium businesses and assets. The need for more insurance services is also necessitated by the inefficiencies in the current service providers

Commercial Banking

As the rate of financial inclusion is relatively low

Microfinance services

To meet the demand for affordable and easily accessible microfinance services

Specialized agriculture insurance services

Climate change risks that create demand for insurance services in sectors such as agriculture.